Credit scoring stands as a cornerstone in the financial world, shaping lending decisions and influencing economic opportunities for individuals and businesses alike. Traditionally, credit scoring relied on standardized methods that often left room for error and bias. However, with the advent of artificial intelligence (AI), a new era of credit scoring has emerged, promising fairer and more accurate systems.

Introduction to Credit Scoring

What is credit scoring?

Credit scoring is a method used by lenders to assess the creditworthiness of borrowers. It involves analyzing various factors such as credit history, debt-to-income ratio, and payment behavior to determine the likelihood of repayment.

Importance of credit scoring in financial systems

Credit scoring plays a pivotal role in financial systems by helping lenders make informed decisions about extending credit. It not only aids in mitigating risk for lenders but also enables individuals and businesses to access capital needed for various purposes, from buying a home to starting a business.

Traditional Credit Scoring Methods

The history of credit scoring dates back several decades, with early methods relying on simple scoring models based on factors like income and employment status. However, as financial systems evolved, so did credit scoring techniques, giving rise to more sophisticated models incorporating a broader range of data points.

Despite these advancements, traditional credit scoring methods have their limitations. They often fail to capture the full financial picture of borrowers and can be prone to biases based on factors such as race, gender, or socio-economic status.

Introduction of AI in Credit Scoring

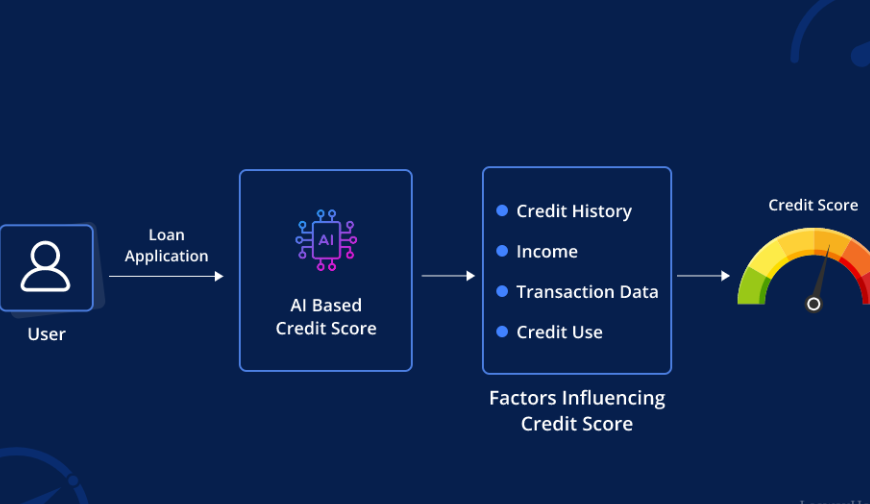

The integration of AI into credit scoring represents a paradigm shift in the way lending decisions are made. By leveraging machine learning algorithms, AI systems can analyze vast amounts of data and identify patterns that may not be apparent to human analysts.

AI-powered credit scoring models have the capability to consider a wider array of factors, including non-traditional data sources such as social media activity and utility payments. This holistic approach allows for more accurate risk assessment and better prediction of borrower behavior.

Advantages of AI-Powered Credit Scoring

Enhanced accuracy

AI-driven credit scoring models excel in accuracy compared to traditional methods. By analyzing large datasets and identifying intricate patterns, these systems can provide more precise risk assessments, reducing the likelihood of default.

Reduction of bias

One of the most significant advantages of AI in credit scoring is its ability to mitigate bias. Traditional scoring models have been criticized for perpetuating discriminatory practices, but AI algorithms can be designed to operate impartially, ensuring fair treatment for all applicants.

Increased efficiency

AI streamlines the credit evaluation process, making it faster and more efficient. Tasks that once required manual review can now be automated, allowing lenders to process applications more quickly and serve a larger customer base.

Innovation and Fairness in Credit Scoring

AI-powered credit scoring represents a significant leap forward in innovation within the financial industry. By harnessing the capabilities of machine learning, lenders can offer more inclusive and equitable access to credit.

Addressing biases in traditional scoring methods

Traditional credit scoring methods have been criticized for their inherent biases, which can result in disparate outcomes for marginalized communities. AI offers the potential to address these biases by focusing on objective data points rather than subjective judgments.

Fairness and inclusivity with AI-driven systems

AI-powered credit scoring systems have the potential to promote fairness and inclusivity in lending. By analyzing a broader range of data, including alternative sources that may better reflect an individual’s financial behavior, these systems can provide more accurate assessments for a diverse range of applicants.

Challenges and Concerns

Despite the promise of AI in credit scoring, there are several challenges and concerns that must be addressed to ensure its responsible deployment.

Data privacy and security

The use of vast amounts of data in AI-driven credit scoring raises concerns about privacy and security. Lenders must ensure that sensitive information is protected and that algorithms comply with relevant regulations such as GDPR and CCPA.

Ethical considerations

There are ethical considerations surrounding the use of AI in credit scoring, particularly regarding transparency and accountability. Lenders must be transparent about how AI algorithms are used in the decision-making process and ensure that they are free from bias and discrimination.

Regulatory compliance

Regulatory compliance is another key consideration in the adoption of AI in credit scoring. Lenders must navigate a complex regulatory landscape to ensure that their AI systems comply with laws and regulations governing lending practices.

Future Trends in AI-Based Credit Scoring

The future of AI-based credit scoring is filled with possibilities, as technology continues to evolve and new innovations emerge.

Continued evolution of AI algorithms

As AI algorithms become more sophisticated, they will continue to improve in accuracy and reliability. This evolution will enable lenders to make even more informed decisions about extending credit.

Integration of alternative data sources

The integration of alternative data sources will expand the scope of AI-based credit scoring, allowing lenders to consider a broader range of factors in their risk assessments.

Personalized credit scoring

Personalized credit scoring represents the next frontier in AI-based lending. By leveraging data analytics and machine learning, lenders can tailor credit offers to individual borrowers based on their unique financial profiles and needs.

Real-world Applications and Success Stories

AI-based credit scoring has already made significant strides in the real world, with many success stories highlighting its potential to revolutionize the lending industry.

Case studies of successful AI implementations

Numerous financial institutions have successfully implemented AI-powered credit scoring systems, resulting in improved accuracy, efficiency, and customer satisfaction.

Impact on lending institutions and consumers

The adoption of AI in credit scoring has had a profound impact on lending institutions and consumers alike. Lenders benefit from reduced risk and increased profitability, while consumers enjoy greater access to credit on fairer terms.

Conclusion

The invention of fairer and more accurate credit scoring systems with AI represents a significant milestone in the evolution of the financial industry. By harnessing the power of machine learning, lenders can make more informed decisions about extending credit, promoting fairness, inclusivity, and economic opportunity for all.

Unique FAQs

- How does AI mitigate bias in credit scoring?

- AI algorithms can be designed to focus on objective data points rather than subjective judgments, reducing the influence of bias in credit scoring.

- What are some examples of alternative data sources used in AI-based credit scoring?

- Alternative data sources may include information such as utility payments, rental history, and even social media activity.

- Are there any regulatory barriers to the adoption of AI in credit scoring?

- Yes, lenders must ensure that their AI systems comply with regulations governing data privacy, consumer protection, and fair lending practices.

- Can AI-powered credit scoring systems adapt to changing economic conditions?

- Yes, AI algorithms are capable of learning and adapting to new information, allowing them to adjust risk assessments based on changing economic conditions.

- How can consumers ensure the responsible use of AI in credit scoring?

- Consumers should advocate for transparency and accountability in credit scoring practices, as well as familiarize themselves with their rights under relevant regulations.